bexar county tax office property search

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Monday-Friday 800 am - 445 pm Wednesdays 800 am - 630 pm Closed on County Holidays.

15 000 Homeowners In Bexar County Eligible For Help On Delinquent Property Taxes Kens5 Com

For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at 2103356628.

. Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County. In addition to Bexar County and the Flood Control Fund the Office of Albert Uresti Bexar County Tax Assessor-Collector has a contractual agreement to collect and disburse property taxes for 56 separate taxing jurisdictions. Chief Appraiser Michael Amezquita predicts a record number of protests or around 160000 could be filed.

You can search for any account whose property taxes are collected by the Bexar County Tax Office. After locating the account you can pay online by credit card or eCheck. Property Tax Payment Options.

The district appraises property according to the Texas Property Tax Code and the Uniform Standards of. Guadalupe County Property Records are real estate documents that contain information related to real property in Guadalupe County Texas. There are several options available to taxpayers including Half Pay and Pre-Payment Plans.

The average increase in local property appraisals was 28. Bexar County b ɛər BAIR or ˈ b eɪ ər BAY-ər. Click Advanced for more search options.

The second step is determining the propertys assessed valueHomesteads assessed value is obtained by subtracting the homestead cap loss value from the appraised value. Albert Uresti MPA PCC Tax Assessor-Collector Bexar County PO. NETR Online Guadalupe Guadalupe Public Records Search Guadalupe Records Guadalupe Property Tax Texas Property Search Texas Assessor.

100 Dolorosa San Antonio TX 78205 Phone. As of the 2020 census the population was 2009324. State of TexasIt is in South Texas and its county seat is San Antonio.

All properties are taxed by Bexar County Flood Control Alamo Community College University Health System San Antonio. 2022 data current as of Jun 13 2022 115AM. The Bexar County Property Records Search Texas links below open in a new window and take you to third party websites that provide access to Bexar County public records.

Prior year data is informational only and does not necessarily replicate the values certified to the tax office. Property Tax Late Charges. Bexar County Property Records Search Links.

The following map displays mortgage and tax foreclosure notices. Bexar County is included in the San AntonioNew Braunfels TX metropolitan statistical areaIt is the 16th-most populous county in the nation and the fourth. A clickable pop-up includes basic property information.

NETR Online Dallas Dallas Public Records Search Dallas Records Dallas Property Tax Texas Property Search Texas Assessor. Béxar is a county in the US. Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details.

Box 839950 San Antonio TX 78283-3950. Prop 2 increases the state homestead exemption from 25000 to 40000 for school district property taxes which according to the Bexar County Tax-Assessor Collector Office makes up about 50 of. For details contact the Bexar County Tax Assessor-Collectors Office.

Monday is the last day to file a property appraisal protest with the Bexar Appraisal District over the most recent round of appraisals. Enter one or more search terms. This applies only in the case of a residential homestead and cannot exceed either the market value or the preceding years appraised value plus 10 the value of any improvements added since the last re-appraisal.

2021 and prior year data current as of Jun 3. Help others by sharing new links and reporting broken links. For inquiries pertaining to foreclosures please contact the County Clerks Office.

Editors frequently monitor and verify these resources on a routine basis.

Bexar County Delinquent Property Taxes Find Out About Bexar County Property Tax Rates More Tax Ease

Bexar County Building Use Bexar County Tx Official Website

Bexar County Tax Office To Stay Open But Close Lobbies What That Means For You

As Property Tax Bills Arrive Protesters Are Encouraged To Act Now Woai

Deadline Arrives For Property Appraisal Protests In Bexar County Tpr

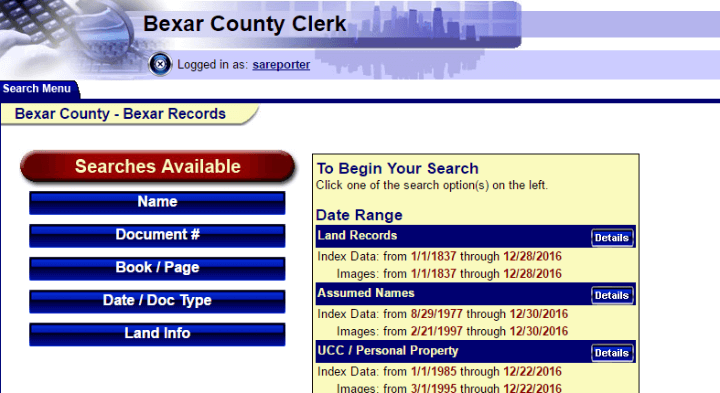

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

Commentary County Has Chance To Study Improve Medical Care In Jail

Bexar County Commissioners Approve Funding For Uh Public Health Division Homestead Property Exemption Tpr

Real Property Land Records Bexar County Tx Official Website

Bexar County Building Use Bexar County Tx Official Website

San Antonio Officials Promote Assistance Amid Surge In Property Appraisals Community Impact

Property Tax Information Bexar County Tx Official Website

Funding Shortfalls Hamper Bexar County Courts Tpr

Everything You Need To Know About Bexar County Property Tax

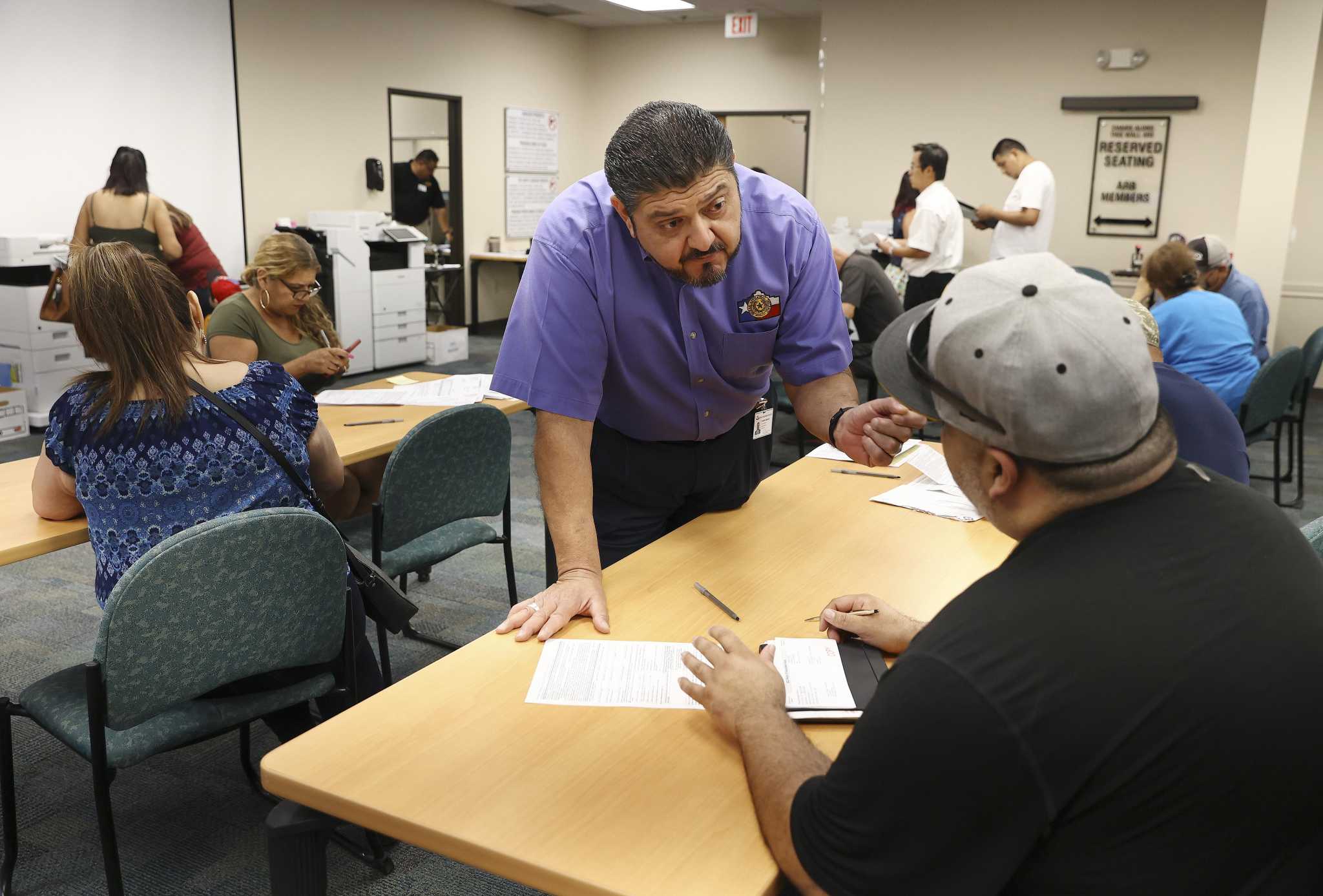

High Bexar County Property Values Prompt Residents To Learn The Art Of Protesting Or Find A Consultant

Bexar County Texas Property Search And Interactive Gis Map

Bexar County Building Use Bexar County Tx Official Website

Property Appraisal Protests Set Record For Bexar County In 2022

The Historic 1892 Bexar County Courthouse In San Antonio Texas Stock Photo Alamy